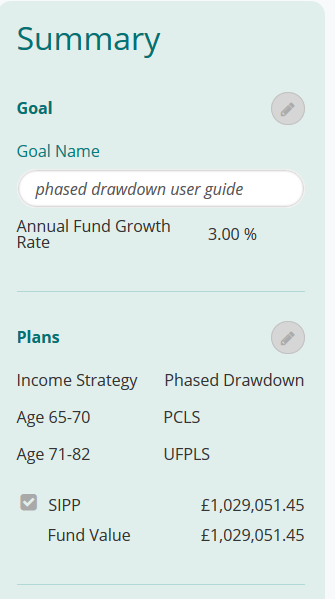

Phased retirement is generally suitable only if you have a fairly large pension fund, or have other assets or income to live on. On death, the balance of the pension fund that has not yet been used for Drawdown Pension can provide a pension for your surviving dependents or a lump sum, depending on the terms of the pension plan. It also provides more flexible help for your survivors if you die. Phased retirement can be a very useful financial planning tool, for example, if you want to ease back gradually on work and start to replace your earnings with pension income. The drawback is that if you stagger the conversion of your pension fund into Drawdown Pension, you will not be able to take all your tax-free cash from your total pension fund at once as a single lump sum.

Phased drawdown free#

Using Your Tax Free Cash EffectivelyĬonverting portions of the fund regularly, for example once a year, means you can effectively use the tax-free cash, as well as the Drawdown Pension payments, to provide your income. To increase your income at a later date, you could either increase the rate of withdrawal (provided you did not exceed the maximum limit if using Capped Drawdown) or start to draw an income, including the tax free cash sum, from a further slice of your pension fund.Įach time you start using a segment (or portion of your pension fund) for Drawdown Pension, you can first take part of the portion’s fund as tax-free cash (normally 25% of the portion). It is also possible to combine Phased Retirement with Drawdown Pension which would mean that you would start to draw an income from just part of your pension fund on one date including the tax free cash sum available from that part, leaving the rest of the fund intact.

0 kommentar(er)

0 kommentar(er)